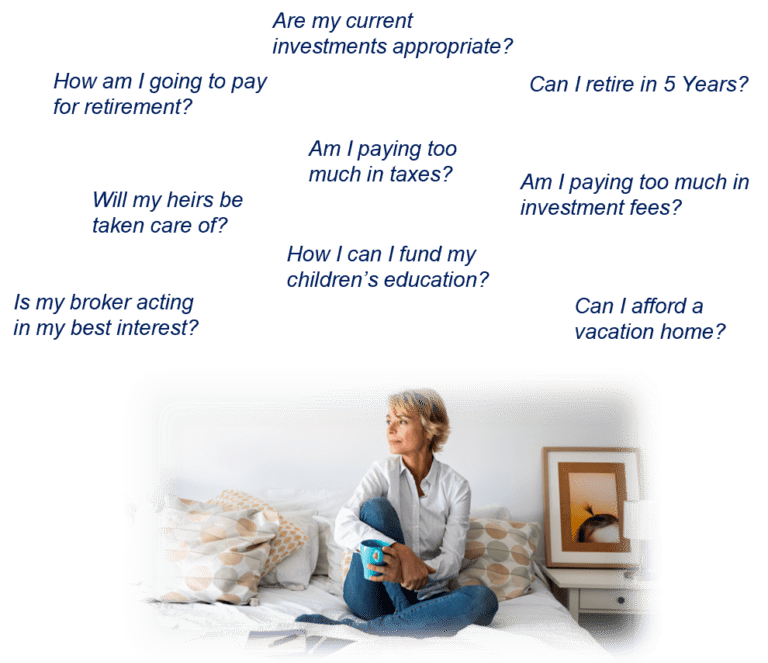

Making good financial decisions is the only way to achieve your most important life goals.

Retirement

Life Goals

Education

Strategy

Oversight

Transparency

Life and Umbrella

Home and Auto

Health

Protect Legacy

Limit Taxes

Provide for Heirs

Tax Planning

Yearly Tax Review

Reduce Taxes

Then – We will establish a strong financial foundation for tomorrow.

We will help bring order to your financial life

We will help you follow through on your financial commitments

We will provide insight from the outside to help you avoid making emotional decisions about important matters

We will help you anticipate the key transitions in your life so that you will be financially prepared for them

We will explore the specific knowledge needed for you to succeed in your situation

We will work with you to help you achieve the best life possible

At Roche Financial Partners, our goal is to be your financial guide through life, — whether you’re just getting started, preparing for retirement, or well into your golden years.

Financial wellness starts with your long term goals, dreams and priorities

© 2022 – Roche Financial Partners | All rights reserved | Web Design by Threshold Solutions